Growth in Africa Opens Doors in Pay TV and VOD

The Current Facts

- The number of pay TV subscribers in Sub-Saharan Africa will increase by 74 per cent between 2017 and 2023 to reach 40.89 million.

- The Sub-Saharan Africa Pay TV Forecasts report estimates that subscriber growth will outstrip revenue progress. Pay TV revenues will climb by 41 per cent to $6.64 billion by 2023, up by $2 billion in 2017.

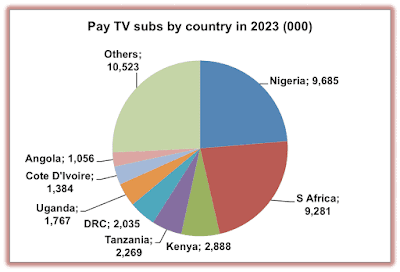

- Nigeria will have the most pay TV subscribers by 2023 – having overtaken South Africa in 2021. The top eight countries will supply three-quarters of the total in 2023.

- Multichoice had 12.48 million subs across satellite TV platform DStv and DTT platform GOtv by end-2017.

- http://www.screenafrica.com/2018/01/08/digital/vod-ott/africa-to-add-17-4-million-pay-tv-subs/

Growth in Africa Opens Doors in Pay TV and VOD

Projected growth of the African entertainment industry is a near-constant topic in the trades. International players are investing in cinema construction, nations continent-wide are transitioning from analog to digital television broadcast, and new regional Pay TV networks and VOD services are gaining strong subscriber numbers. But how does one sell to this burgeoning market and what avenues of distribution are most profitable for independent films?

The African continent includes 54 recognized sovereign states. However, as a film and television sales territory, much of the continent is often licensed together, divided by language. English language rights are typically sold to South African distributors who buy for their home state, surrounding nations or the entire continent. Rights for French-speaking Africa are usually included in a deal with a French distributor who then sub-distributes to the continent. Arabic rights are usually sold to Middle Eastern distributors who buy for all of the Middle East and North Africa.

Outside of South Africa, there is a limited theatrical market for independent films. Challenges include a lack of cinema screens, low ticket prices, and the growing popularity of online streaming. International companies such as France’s Vivendi and IMAX are investing in state of the art theaters in the hopes of raising ticket prices and bringing a larger audience to the cinema. Opportunities for independents should grow as the screen count increases but it will be a number of years before the market is developed enough to support meaningful revenue.

The main obstacles of the television market are the low TV household penetration (due to various economic factors) and the ongoing transition to digital television broadcast. Full transition to digital television is far complete but its continuing expansion throughout the continent allows a greater number of channels to broadcast at lower costs. The increased number of TV channels is creating more demand for international programming.

Emerging Pan-African Pay TV networks are benefiting independent films and TV series. Market entrances by StarTimes, Zuku, and Econet’s Kwese TV are stirring up competition in a territory historically dominated by Multichoice’s M-Net and Vivendi’s Canal+ International. While the established Pay TV networks have output deals with U.S. major studios, the new companies are hungry for exclusive content and acquiring from the independents.

When selling to a Pan-African Pay TV network, the deal can be as broad as the entire continent including adjacent ocean islands. As the majority of Pay television networks broadcast across a number of nations, deals often include multiple languages and territories. Because one operator’s services can vary greatly from nation to nation, buyers will typically ask for pay television rights as well as any and all on-demand or digital streaming rights.

Online video streaming is another emerging market with opportunities for independent films and TV series. Despite low internet penetration, poor broadband speeds, and lack of credit card penetration, VOD services are growing in popularity. The online platforms offer offline streaming, downloading and video compression to adjust to the unique needs of subscribers. SVOD is the most profitable sector with international players such as Netflix, Amazon and iFlix as well as regional services including Showmax, Traceplay and Nuvu available to the consumer. Similar to Pan-African Pay TV, these services often buy regional rights including several languages and territories.

While the growth of Africa’s entertainment industry isn’t fully realized for the Independents in the theatrical sector, emerging Pan-African Pay TV networks and VOD services are creating new avenues of distribution and revenue possibilities.

Growth in Africa Opens Doors in Pay TV and VOD | Independent Film & Television Alliance

http://www.ifta-online.org/growth-africa-opens-doors-pay-tv-and-vod.

COMING SOON

Comments

Post a Comment